Crypto Investing Wisdom: 10 Visualized Lessons

In the ever-evolving world of cryptocurrencies, staying level-headed and following a disciplined approach is crucial. Here are 10 powerful lessons, visualized, to help you navigate the crypto markets:

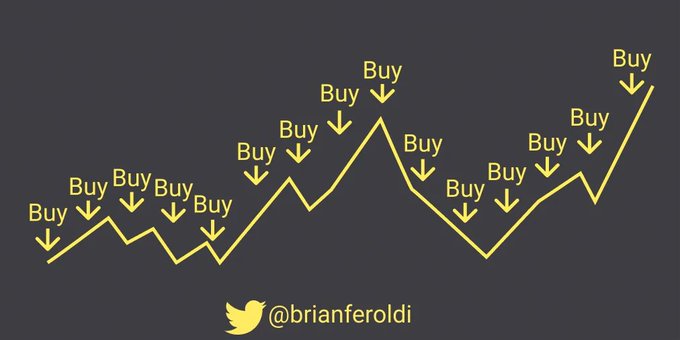

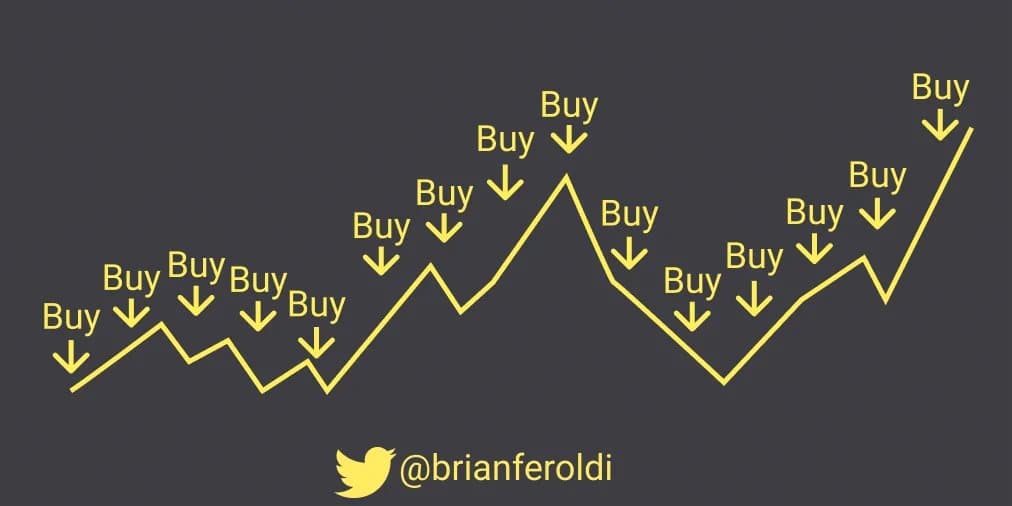

1. Dollar-Cost Averaging Makes Market Timing Irrelevant:

Timing the crypto markets is an uphill battle. By employing a dollar-cost averaging strategy, where you invest a fixed amount at regular intervals, you eliminate the need for perfect timing and let compounding work its magic.

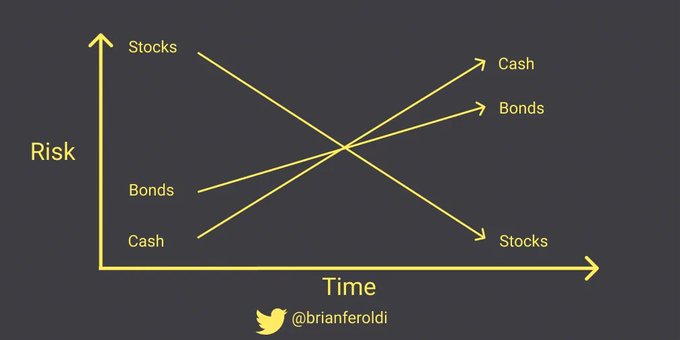

2. Cash vs Crypto: Short vs Long-Term Safety:

Crypto is Short-Term Risky, but Long-Term Safe While holding cash may seem safe in the short run, its value erodes over time due to inflation. Conversely, crypto may exhibit volatility in the short term, but its finite supply and potential for widespread adoption make it a compelling long-term investment.

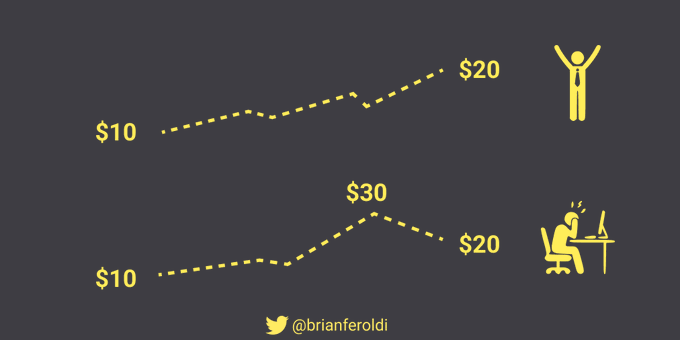

3. Expect the Crypto Markets to Play Mind Games with Your Emotions:

The crypto markets are highly volatile and can take you on an emotional rollercoaster. Expect periods of euphoria followed by gut-wrenching crashes. Maintaining a level head is paramount.

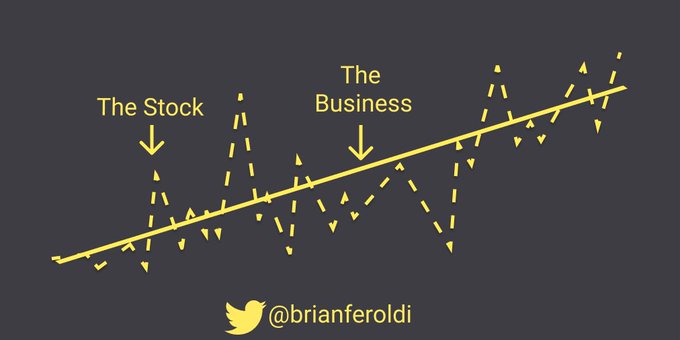

4. Watch the Technology, Not the Price:

While price movements can be alluring, true value lies in the underlying technology and adoption. Focus on understanding the fundamentals and use cases rather than obsessing over short-term price fluctuations.

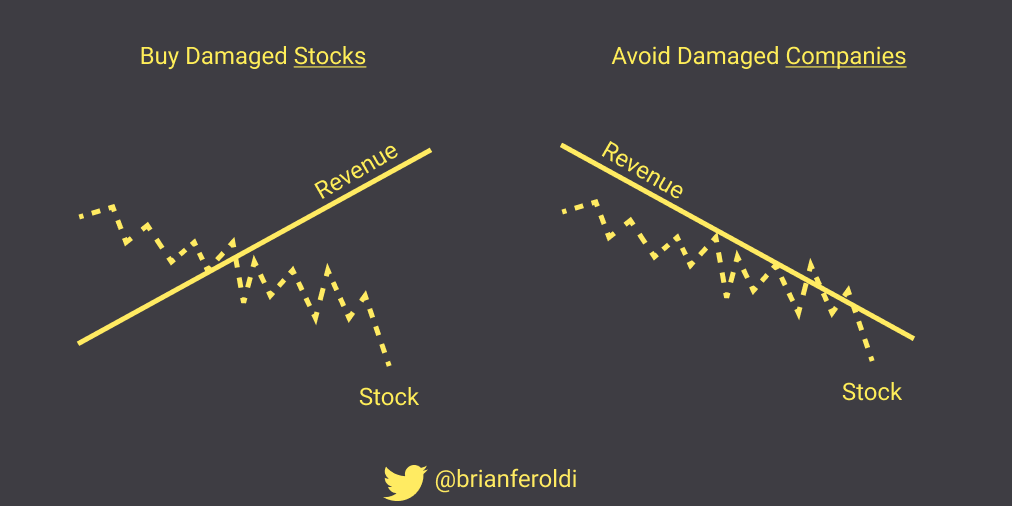

5. Buy Discounted Crypto. Avoid Damaged Projects:

Just as with stocks, crypto assets can become undervalued due to market irrationality. Seize these opportunities to accumulate high-quality projects at a discount. However, steer clear of projects with fundamental flaws or lacking real-world utility.

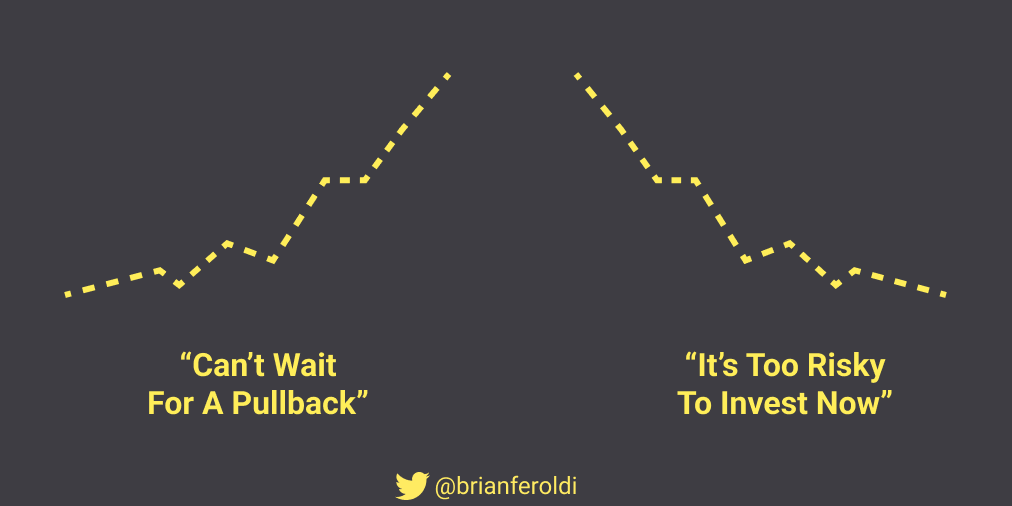

6. Being Greedy When Others are Fearful is Easier Said Than Done:

It's easy to preach about buying the dip when the market is bullish. But when fear and panic grip the market, mustering the courage to invest can be incredibly challenging. Prepare yourself mentally for such situations.

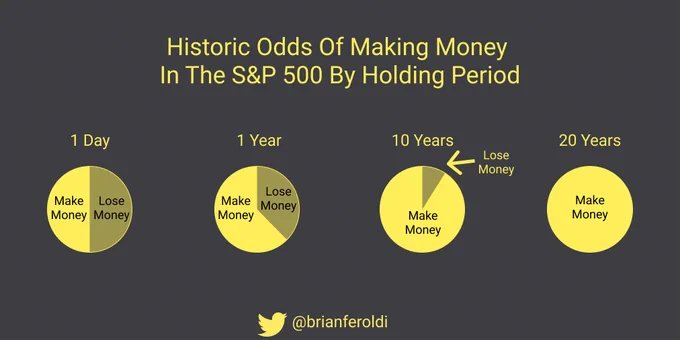

7. The Best Way to Double Your Odds of Success is to Double Your Holding Period:

Patience is a virtue in the crypto world. By extending your holding period, you increase your chances of success by riding out the volatility and capturing the long-term potential of promising projects.

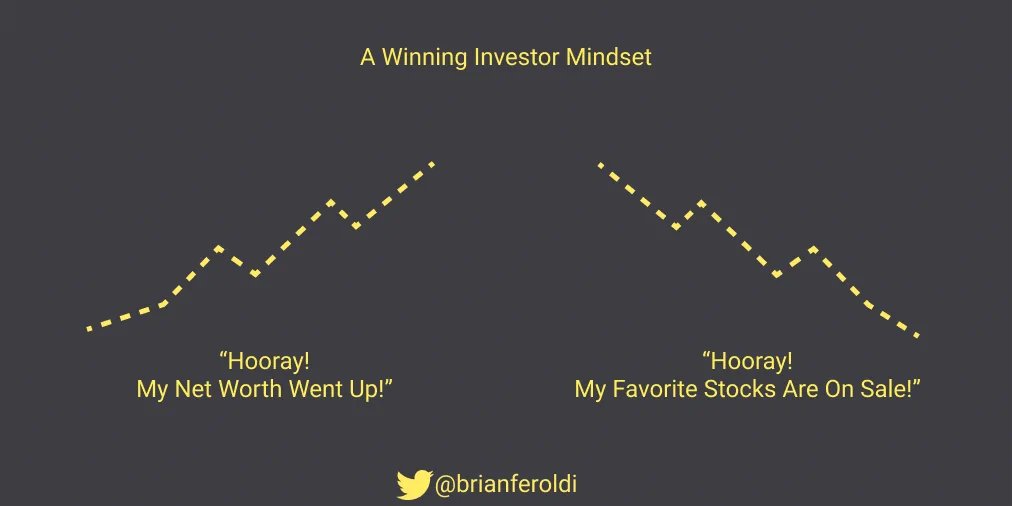

8. Developing the Right Mindset is 95% of Investing Success:

cultivating the right mindset is crucial. Approach the crypto markets with a long-term perspective, emotional discipline, and a commitment to continuous learning.

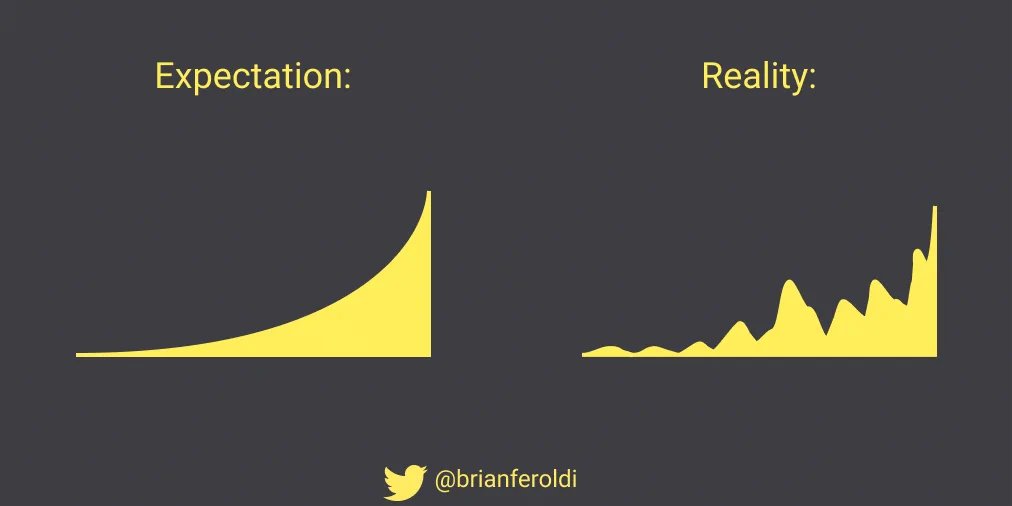

9. Planning is Useful, but the Real World Rarely Matches a Spreadsheet:

While planning and strategizing are essential, the crypto markets are inherently unpredictable. Remain flexible and adapt your approach as new information emerges.

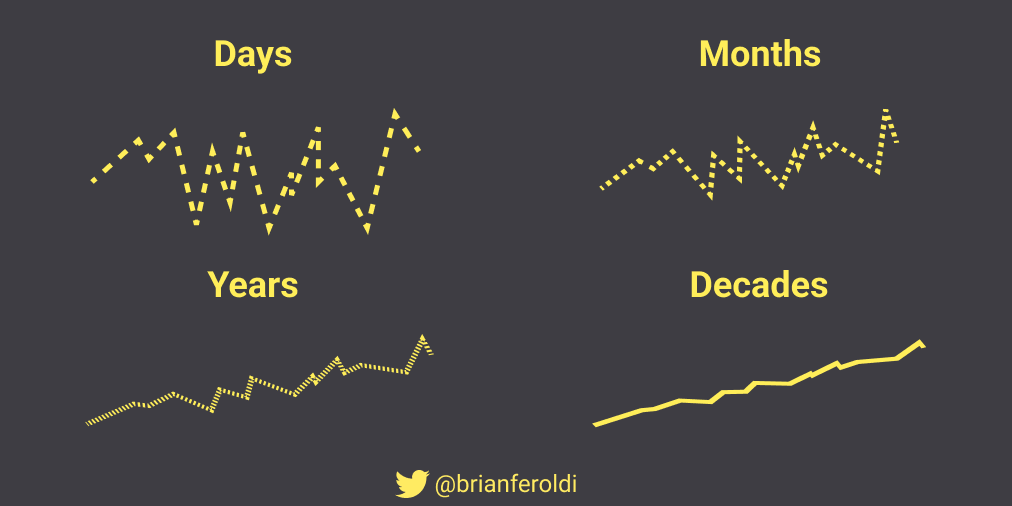

10. Zoom Out:

Amidst the daily price fluctuations and news cycles, it's easy to get caught up in the noise. Take a step back and zoom out to gain perspective on the bigger picture and long-term trends shaping the crypto landscape.

Remember, investing in cryptocurrencies requires a combination of knowledge, discipline, and a strong mental fortitude. By internalizing these lessons, you'll be better equipped to navigate the crypto markets and potentially reap the rewards of this revolutionary asset class.