Understanding Whale Manipulation in Crypto Markets: A Trader's Guide

Ever wondered why 90% of people lose their savings in the crypto market? It's not just about luck or skill - it's often due to whale manipulations. These big players have a significant influence on the market, and understanding their tactics can be the difference between success and failure.

I've spent countless hours investigating these manipulation techniques, and I'm here to share what I've learned. No $1,000 courses or hidden fees - just straight-up information to help you protect your investments.

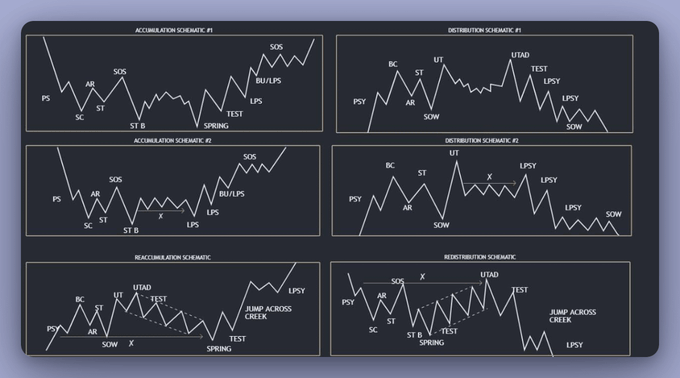

The Whale's Playbook

Whales typically follow a specific pattern:

- Asset accumulation

- Pump

- Reaccumulation

- Pump

- Distribution

- Dump

- Redistribution

- Dump

By recognizing this cycle, we can identify their main manipulation strategies.

Top Whale Manipulation Tactics

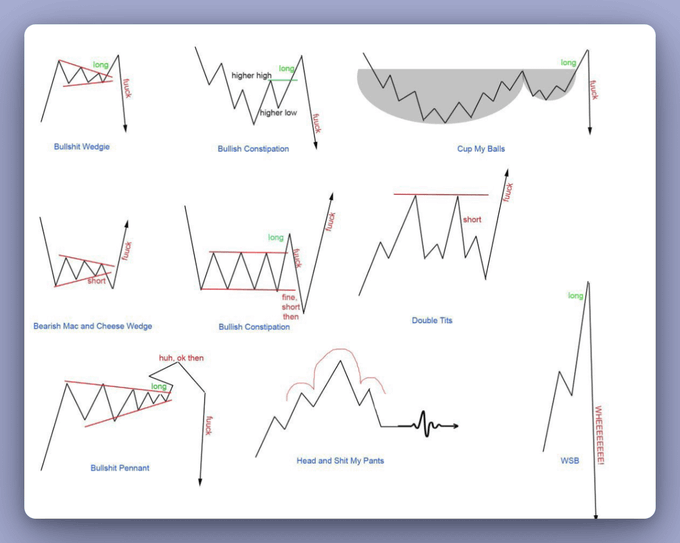

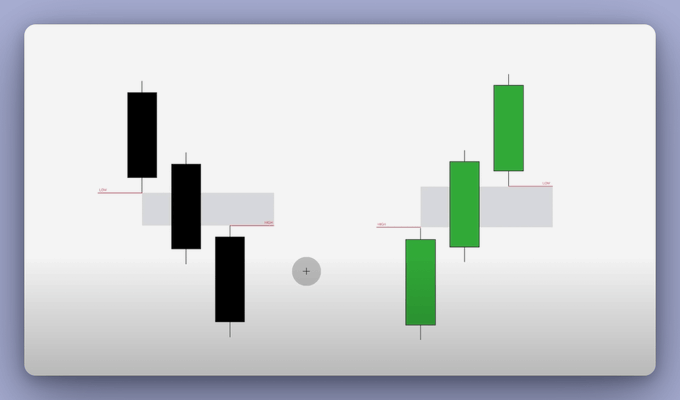

1 Faking the Patterns : Whales create misleading chart patterns by strategically buying at resistance or selling during bounces. This tricks retail traders who rely on these patterns as market indicators.

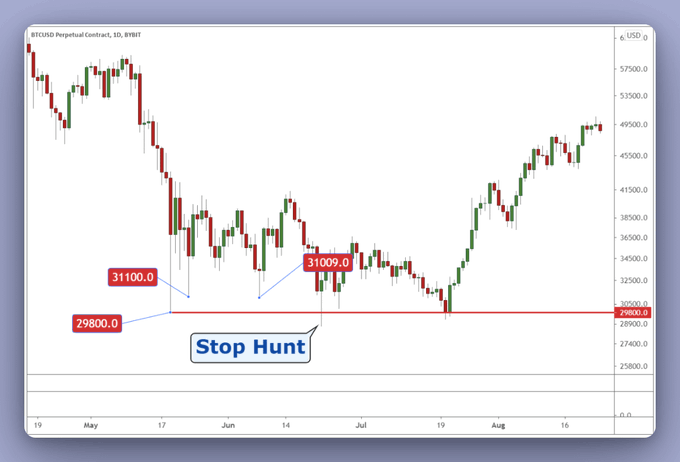

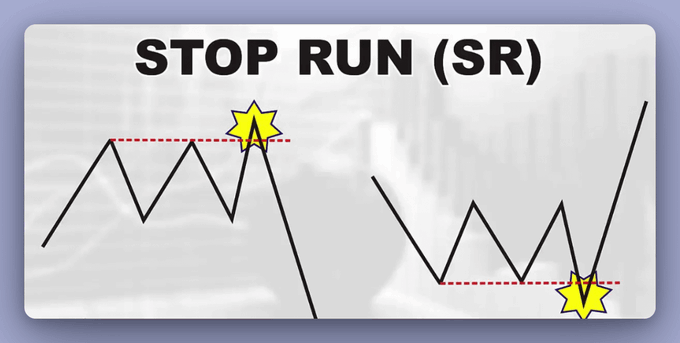

2 Stop Loss Hunting : Big players identify clusters of stop-loss orders and drive prices toward these levels, triggering a cascade of liquidations and rapid price swings.

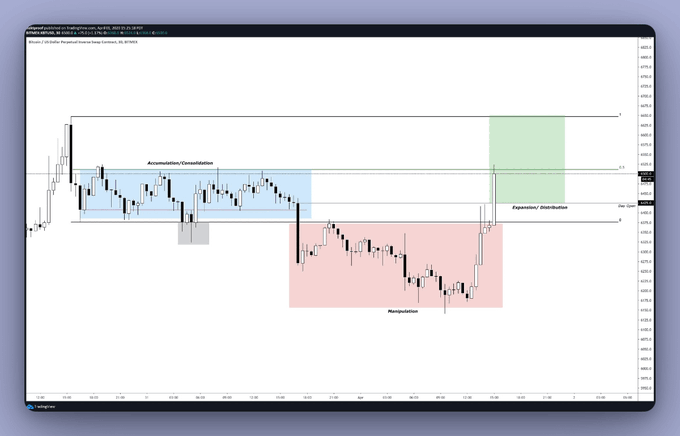

3 Range Manipulation : Whales push prices to reduce their entry point, causing some traders to exit at a loss. Watch out for consolidation phases that end after 4-5 touches, breaking top or bottom lines.

4 Fair Value Gap (FVG) Exploitation : FVGs occur from intense buying or selling, leading to notable price shifts and chart gaps. Whales capitalize on these gaps, often prompting latecomers to exit positions during pullbacks.

5 Stop Runs : Large players push prices past critical support or resistance points to trigger stop orders, creating cascading movements. They then swiftly reverse within the range, catching traders off guard.

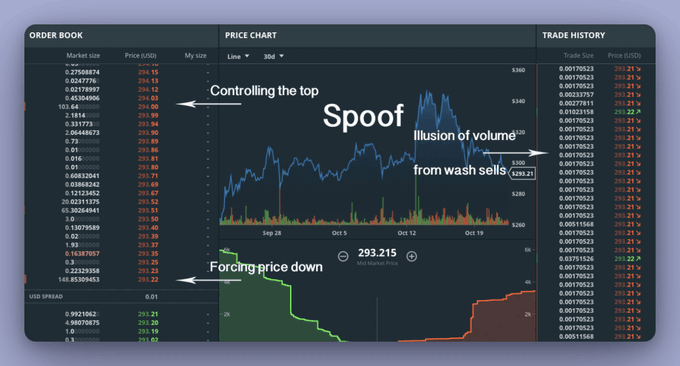

6 Wash Trading : This technique artificially inflates an asset's value by increasing its trading volume. Traders move crypto between their own wallets or exchange accounts to create the illusion of high demand.

7 Spoofing Market Orders : Whales place and cancel fake orders to deceive traders and bots, impacting price movements. To avoid this trap, use limit orders and don't react to temporary walls.

8 Closing the Jaws : Whales place significant buy and sell orders at closing prices to influence the market. Watch out for descending buy walls and ascending sell orders that compress prices.

- Two-Sided Market Manipulation : By placing large orders on both bid and ask sides, whales can manipulate prices in either direction, catching retail traders off guard with rapid price swings.

Protecting Yourself: A Cheat Sheet.

To avoid being outplayed by these market movers, follow these tips:

- Avoid setting stop-losses at obvious levels

- Wait for confirmation before investing

- Allow key support or resistance levels to break decisively

- Resist FOMO during sudden pumps or low-volume trades

- Examine bid and ask spreads closely

- Stay patient, stick to your plan, and wait for the right opportunity

Remember, knowledge is power in the crypto market. By understanding these whale tactics, you're already ahead of 90% of traders. Stay vigilant, keep learning, and may your trades be ever in your favor!

Remember, every second you spend not using our Mev Sandwich Flashbot is another second you're leaving money on the table. And let's be real, you can't afford to keep doing that, can you?

So, are you ready to step up and join the big leagues? Or are you content watching from the sidelines as others rack up gains that would make your grandma blush?

The choice is yours. But choose fast, because these sandwiches are going quicker than free beer at a frat party.